Boost Your Job Search with ChatGPT: Your Secret Weapon for Landing a Job

In today’s competitive job market, finding ways to stand out from the crowd is essential. With the advancement of technology, ChatGPT has emerged as a powerful tool that can significantly aid you in your job search. In this article, we will explore all the ways ChatGPT can help you land a job. Whether you’re a recent graduate or an experienced professional, leveraging this AI-powered assistant can give you the edge you need to secure your dream job. Let’s dive in and discover how ChatGPT can revolutionize your job search strategy.

Resume Optimization

Crafting an impressive resume that catches the attention of recruiters is crucial. With ChatGPT, you can receive valuable feedback and suggestions to optimize your resume. From formatting and layout to content and keywords, ChatGPT can provide insights on how to tailor your resume to specific job descriptions and industries. It can help you highlight your skills, experiences, and accomplishments in a way that aligns with the expectations of potential employers.

Advertisment

Interview Preparation

Preparing for interviews can be nerve-wracking, but ChatGPT is here to help. It can simulate interview scenarios and provide you with practice questions based on your desired job role or industry. By engaging in conversation with ChatGPT, you can enhance your ability to articulate your thoughts, improve your confidence, and refine your responses. Additionally, ChatGPT can offer valuable tips and strategies to tackle common interview questions, ensuring you’re well-prepared to impress hiring managers.

Advertisment

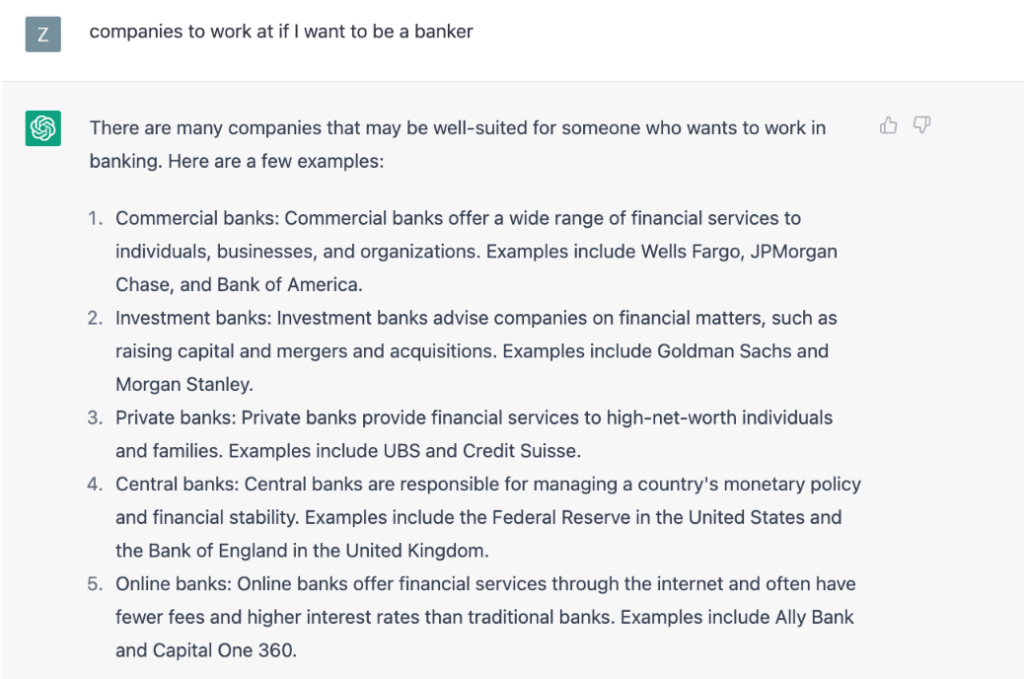

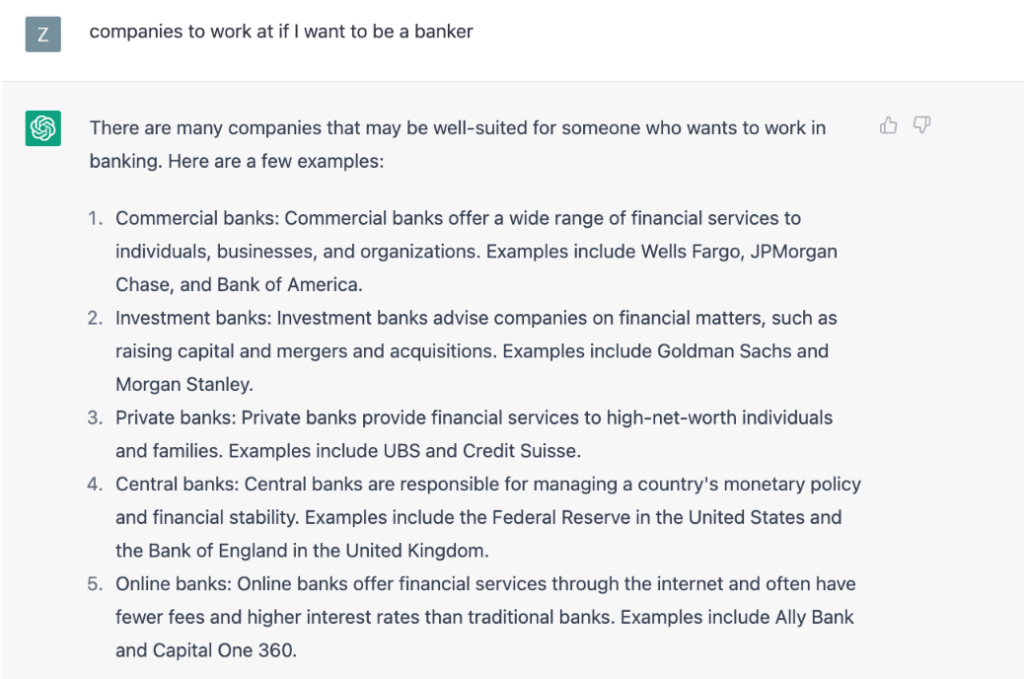

Career Guidance and Mentorship

Navigating your career path can be challenging, but ChatGPT can serve as your virtual career mentor. It can provide insights into various industries, job roles, and career paths based on your interests and qualifications. By engaging in conversations with ChatGPT, you can gain valuable advice on career development, professional growth opportunities, and strategies to advance in your chosen field. It’s like having a personalized career counselor at your fingertips.

Advertisment

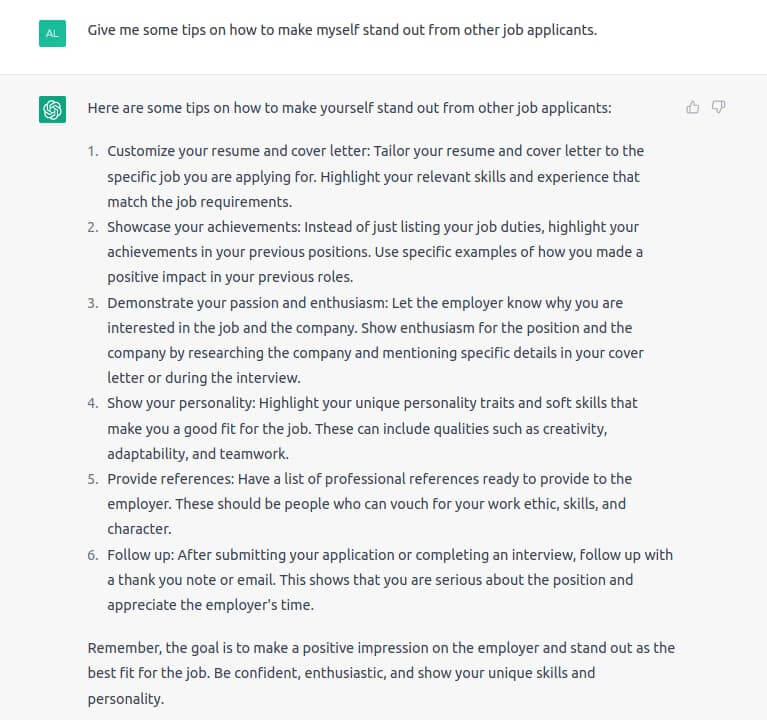

Job Search Assistance

Finding the right job opportunities can be time-consuming and overwhelming. ChatGPT can simplify the process by providing personalized job recommendations based on your preferences, skills, and location. It can help you discover hidden job openings, provide insights into the hiring landscape, and even offer tips on how to tailor your application materials for specific companies. With ChatGPT by your side, you can streamline your job search and increase your chances of finding the perfect job.

Advertisment

Conclusion

ChatGPT is a game-changer in the job search arena, offering invaluable assistance throughout every stage of the process. From optimizing your resume to preparing for interviews, receiving career guidance, and finding job opportunities, ChatGPT can be your trusted companion on your journey to landing a job. Embrace the power of AI technology and leverage ChatGPT’s capabilities to enhance your job search strategy. With its guidance and support, you can confidently navigate the competitive job market and secure the job of your dreams. Good luck on your job search!