Speeding Up Your Debt-Free Journey: Tips for Paying Off Debt Faster

Debt can be overwhelming, and it can feel like there’s no end in sight. However, there are steps you can take to pay off debt faster and gain financial freedom. Here are some tips to help you get started.

Assess Your Debt Situation

Before you can create a plan to pay off your debt, you need to know exactly how much you owe and to whom. Make a list of all your debts, including the outstanding balances and interest rates. This will give you a clear picture of your financial situation.

Advertisment

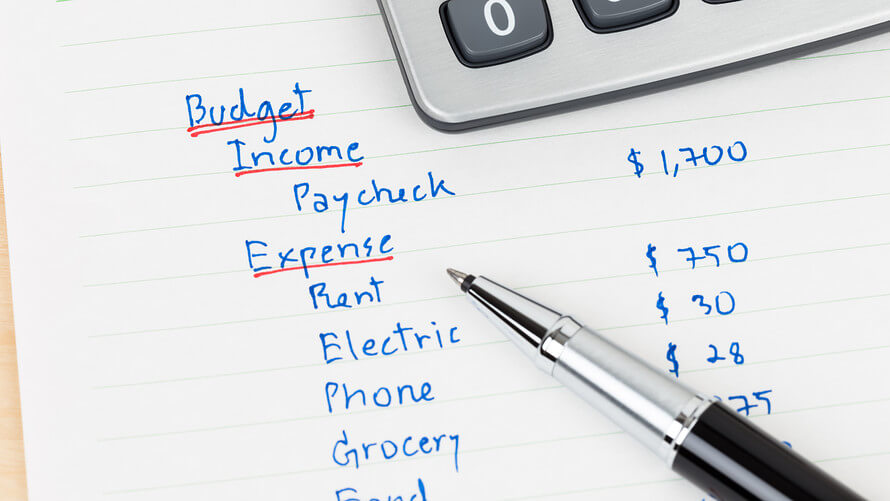

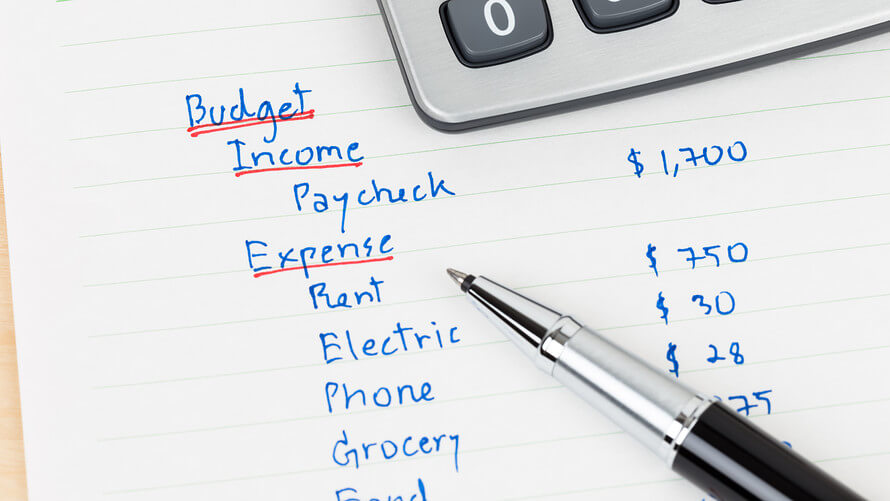

Create a Budget

Creating a budget is essential if you want to pay off debt faster. It will help you identify areas where you can cut back on expenses and allocate more money toward your debt payments. Make sure to include all your expenses, including monthly bills, groceries, and discretionary spending.

Advertisment

Prioritize Your Debts

Not all debts are created equal. Some may have higher interest rates than others, making them more expensive in the long run. Prioritizing your debts will help you focus on paying off the most expensive ones first, which will save you money on interest charges.

Advertisment

Consider Debt Consolidation

If you have multiple debts with high interest rates, consolidating them into one loan with a lower interest rate can help you save money and pay off debt faster. You can do this by taking out a personal loan or transferring balances to a balance transfer credit card.

Advertisment

Increase Your Income

Finding ways to increase your income can help you pay off debt faster. Consider taking on a part-time job or selling items you no longer need. You can also ask for a raise or look for a higher-paying job.