How to open an account on ExpertOption

The platform offers two types of accounts – demo and real. With the former, you don’t have to register and do a verification – you can begin immediately.

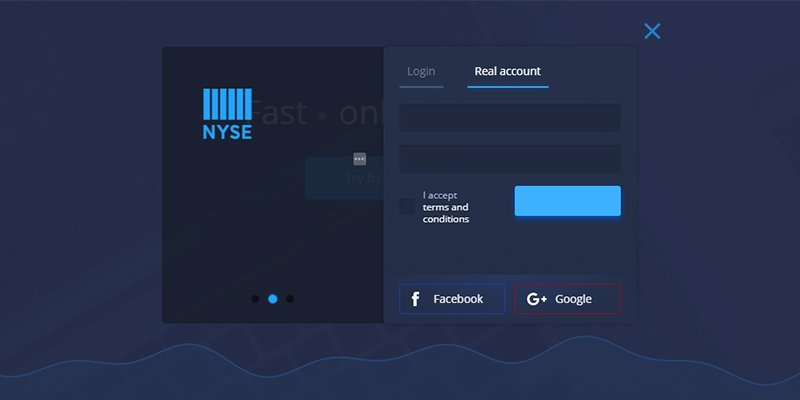

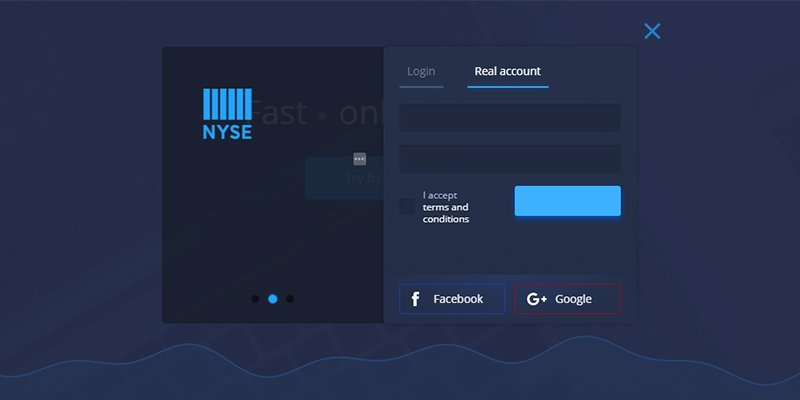

Creating a real account

You can practice trading using the demo account but you are still working with virtual funds. Creating a real one enables you to win and withdraw money. To create one do the following:

Go to the real account button at the top of the screen.A pop-up appears where you have to submit your email, Facebook, or Google account and a secure password. Accept the terms and conditions and finish by clicking the Account button.

After that you are done. You still have to verify it via email. Afterwards, your account will be activated, but you still have to do an identity verification and deposit money.

Moving average technical indicator

The platform offers tools which help with the trading. Check out the moving average which shows a green line that moves in the same direction as the price fluctuations and displays the average value. It is very useful for setting upper and lower price limits and predicting a good strike rate. You can also see the price trend for a period of time.

How to use it?

Go to indicators on the platform and click on moving average’. Pick the average period, color, type and width. Click on apply’ and the moving average line will be displayed. Analyze the graph for a while.Is there a trend? The point where the line cuts below the price fluctuation indicator is the strike price. Go to the p button to view previous trends. There might be some repetition. If the moving average line cuts above the price fluctuation indicator and stays above it you should go for the down button.

You can learn more about the movement of the market in the educational section.

Account verification

By verifying your account you prove that you are not a bot but a real trader helps with funds security. If someone else tries to withdraw money from your account, he won’t be allowed.

Click on finances, and withdrawal and then confirm information button.

You will have to upload a photo of your ID and a photo of your credit card. Then submit your email, address and other information. Click save changes’ and submit. It might take up to 3 days for the verification to be done.

Making money by copying other traders

A unique feature of the platform is connected to following and copying other traders. It doesn’t matter where they are located. If you are a beginner, this is a great strategy. This also makes it very easy to go in and out of trades at the right moment. Here is how to do it.

Click on the social icon. A window will appear with all the traders who are online, the opened deals, and the people who are trading with the same asset as you. You can predict the up or down position based on what others are choosing. Next, just copy whatever they are doing.